apexcapitalsolutionshelps you find the best commercial real estate financing.

Property Owners

1. Introduction Call and Loan request.

Our team at Apex capital understand how important relationship building means to current and future clients. In our first step we make a huge emphasize on understanding what your current situation is and familiarizing ourselves with what your goals are as a Real Estate investor. After we get an understanding of what is needed to meet your investing goals we gather information on your current deals and begin the process of finding the best offers that are most beneficial for you and your business.

2. Loan Quote Review

Moving forward to our 2nd step, we here focus on connecting with our network of private lenders to begin looking for the best quote possible. In this step we gather further documentation and discuss potential options on what some loan scenarios can look like based on deal structure, numbers and borrower profile. Time and efficiency is one of the things we focus on the most because we understand time is an investors most valuable asset.

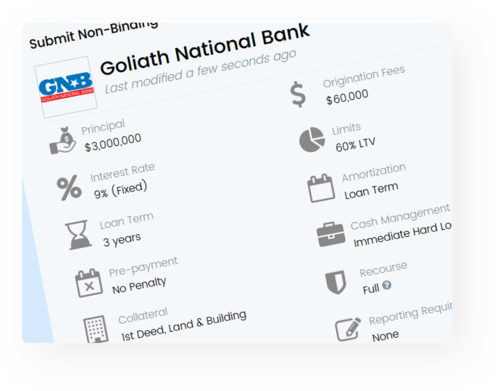

3. Analyzing quotes

In this step we discuss all of the different offers that have been brought to the table and see which ones fits your needs. Transperancy is our goal here, in the situation where financing needs aren’t being met we analyze what aspects of the offer can be adjusted and make changes based on what our lenders can provide.

4. Obtaining Finalized Loan offer

In our last step we we analyze what are the best offers on the table and proceed with lender parameters for financing request. Here we connect the investor with our designated underwriter and move forward on collecting documents and signing term sheets to close on the deal.