Compare Your Small Business Loan Options

Apex is the go-to financial resource for every small business, here to equip you with the information you need to make better business decisions. While we review a wide variety of services on the market, we’ve brought on only the top options as our partners. This can, at times, impact how and where their products appear on Apex. And while we are compensated by our partners, the opinions of our editorial team represent an objective and independent evaluation of the products on the market. We’ll guide you toward the best decision for your business, whether we get compensated for it or not. Learn more about our editorial process and how we make money.

Explore the top small business loans and find the right fit for your business’s needs.

At some point in the lifecycle of your business, you’ll need access to financing—whether to cover cash flow, expand your team, cover an emergency, purchase equipment, or for a different purpose altogether. Small business loans can offer you the capital you need to run and grow your business.

Traditionally, business loans were only available from established banks, which, although offering the best rates and terms, also require lengthy processes and the highest qualifications—making it difficult for many small business applicants to get the funding they need. Today, however, between banks, government-guaranteed loans, and alternative, online lenders, there are now more options than ever for small businesses to get access to capital—including everything from term loans to lines of credit to asset-based financing.

You can use this guide to learn more about the best business loan products and top lenders offering them.

Where to Get a Small Business Loan

Traditionally, you could only get business loans from established banks. These loans offer the best rates and terms but also require lengthy processes and the highest qualifications—making it difficult for many small business applicants to get the funding they need. Today, however, between banks, government-guaranteed loans, and alternative, online lenders, there are now more options than ever for small businesses to get access to capital.

How to Qualify for a Business Loan

Ultimately, qualifications for a business loan largely depend on the lender you’re working with and the loan product you’re applying for. Generally, the better your personal credit, stronger your annual revenue, and longer your time in business, the more likely you are to qualify for a small business loan—and one with the most desirable rates and terms. However, even if your qualifications aren’t ideal, there may still be options for you.

Best Business Loans and Lenders in 2021

Compare the top loan options and lenders to see what’s right for you.

SBA Loans

SBA loans are government-guaranteed term loans that allow lenders to offer low-interest rates to business owners who might not qualify for a bank loan.

AMOUNT

$5K - $5M

TERMS

5 - 25 Years

RATES

Starting at 6%

SPEED

As fast as 2 weeks

- Pros

- Lowest down payments

- Longest payment terms

- Reasonable interest rates

- Cons

- Lengthy paperwork

- Longer approval time

- May require collateral

BEST ONLINE TERM LOAN LENDERS

SmartBiz

Best for: Low-rate, SBA loans.

SmartBiz is a preferred SBA lending partner, offering SBA 7(a) loans. SmartBiz can offer SBA loans with some of the best rates and terms available. These loans can be used for a variety of purposes and are well-suited for newer businesses, as well as established, highly qualified businesses that are looking for long-term financing.

Business Term Loans

Online term loans are lump sum loans designed to accommodate a wide variety of businesses and their funding needs. The repayment period and rates of an online term loan will depend on the lender—however, short-term loans can have a repayment period of a few months up to a year, and long-term loans from a year to five years.

AMOUNT

$5,000 to $600,000

TERMS

3 months to 3 years

RATES

7% to 30%

SPEED

As fast as three hours

- Pros

- Set payment structure

- Bad credit is acceptable

- Cons

- Potential prepayment penalties

BEST ONLINE TERM LOAN LENDERS

OnDeck Capital

Best for: Access to shorter-term financing with a pre-payment discount.

OnDeck is an online lender that provides fast, short-term financing in amounts up to $500,000. Short-term loans from OnDeck are great for covering big, unexpected expenses and can be used for virtually any purpose. OnDeck’s loan application can be completed quickly and easily online and they can fund businesses in as little as one day. Plus, unlike many alternative lenders, OnDeck offers a prepayment discount on your interest-owed if you pay back your loan early.

Idea Financial

Best for: Fast, flexible revolving business lines of credit.

Idea Financial is an online lender that offers flexible revolving business lines of credit. With Idea Financial, you can access credit lines of up to $250,000 with repayment terms of up to 18 months. Idea has flexible payment options so you can repay on a weekly, bi-weekly, or monthly basis and only pay interest on the funds you draw. Additionally, with no origination fees, pre-payment penalties, and an online demand portal for withdrawing funds, Idea Financial makes it easy for you to draw from and afford your business line of credit.

Business Lines of Credit

Business lines of credit are one of the most flexible forms of financing—giving you the ability to draw from a set pool of funds when you need capital. Unlike a traditional term loan, you’ll only need to repay the capital you withdraw, plus interest.

AMOUNT

$5,000 to $250,000

TERMS

Up to 18 months

RATES

7% to 25%

SPEED

As fast as one day

- Pros

- Only pay interest on funds drawn

- Capital is available when needed

- Cons

- Lenders may place a UCC-lien

- Harder to qualify for

BEST LINES OF CREDIT LENDERS

National Corporate Credit

Best for: Startups trying to establish business credit.

National Corporate Credit is an online lender that helps startups establish revolving business lines of credit in amounts up to $150,000. As a startup there is no revenue so to establish this business line of credit the personal credit must meet certain requirements. Contains a 0% interest rate introductory rate that ranges between 6-24 months, an amazing thing to have as a startup when the revenue still isn’t there.

Idea Financial

Best for: Fast, flexible revolving business lines of credit.

Idea Financial is an online lender that offers flexible revolving business lines of credit. With Idea Financial, you can access credit lines of up to $250,000 with repayment terms of up to 18 months. Idea has flexible payment options so you can repay on a weekly, bi-weekly, or monthly basis and only pay interest on the funds you draw. Additionally, with no origination fees, pre-payment penalties, and an online demand portal for withdrawing funds, Idea Financial makes it easy for you to draw from and afford your business line of credit.

Invoice Financing

Invoice financing is a form of asset-based financing in which your unpaid invoices serve as collateral on the capital you borrow from a lender. Generally, invoice financing lenders can advance capital worth up to 85% of the value of your invoices with the 15% (minus fees) paid when your invoices are fulfilled.

AMOUNT

TERMS

RATES

SPEED

Up to 100% of invoice value

Until the customer pays the invoice

Approx. 3% processing fee, plus factor fee (~1%) each week until invoice is paid

As fast as one day

- Pros

- No need to wait for invoice payment

- Invoices serve as collateral

- Easier to qualify for

- Cons

- Can have higher fees than traditional financing

- Fees based on time for invoice to be paid off

BEST INVOICE FINANCING COMPANIES

BlueVine

Best for: Fast, accessible business lines of credit.

BlueVine is an online lender that offers lines of credit with a fast and fully digitized application and underwriting process. Lines of credit from BlueVine are worthwhile for business owners looking to fulfill a specific, short-term financing need—as well as for newer businesses. With their speed and flexible requirements, BlueVine lines of credit are also good for businesses who can’t qualify for a more traditional financing option.

AltLINE

Best for: Fast access to invoice factoring for businesses who need at least $15,000 per month in factoring

altLINE is an invoice factoring company and part of the commercial financing division of The Southern Bank. altLINE offers invoice factoring of up to $4 million per month (with a minimum $15,000 per month required) and up to 90% of an invoice’s amount. Businesses can apply for invoice factoring through altLINE quickly and easily online—and altLINE will look at your accounts receivables and credit quality of your customers to determine your eligibility. altLINE is a great option for businesses whose cash flow is consistently tied up in unpaid invoices, especially since as an invoice factoring company, they’ll handle the process of retrieving payments from your customers.

Equipment Financing

Equipment financing is a type of small business loan given for the specific purpose of purchasing new or used equipment. You can get an equipment loan equal to up to 100% of the value of the equipment you’re looking to purchase, which you’ll then pay back over time, with interest.

AMOUNT

TERMS

RATES

SPEED

Up to the amount of equipment

5 to 6 years

4% to 40%

As fast as 2 days

- Pros

- Quick access to cash

- Limited paperwork

- Equipment serves as collateral

- Cons

- Equipment could be obsolete by the time the loan is fully repaid

BEST EQUIPMENT LENDERS

Everlasting Capital

Best for: Fast access to both short and long-term equipment loans.

Everlasting Capital provides both a financing and leasing a option. Startups can get funding up to $50,000 and non startups can get up to $150,000. Everlasting has flexible qualification requirements. Equipment financing/leasing is a great option for businesses looking to purchase a piece of equipment.

Factoring Financing

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable to a third party at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

- Pros

Faster Cash Supply

Collections Assistance

Concierge Services

- Cons

Interest Fees

Customer Reactions

Another System to Manage

Payment Default Risk

BEST Factoring Financing LENDERS

Paragon Financial Group

Best for:Fast access to invoice factoring for businesses who need at least $40,000 per month in factoring.

Paragon Financial is an invoice factoring company that offers invoice factoring of up to $5 million per month (with a minimum $40,000 per month required) and up to 90% of an invoice’s amount. Paragon will look at your accounts receivables and credit quality of your customers to determine your eligibility. Paragon Financial is a great option for businesses whose cash flow is consistently tied up in unpaid invoices, especially since as an invoice factoring company, they’ll handle the process of retrieving payments from your customers.

TAB bank

Best for: No personal credit requirement with fast access and great for trucking companies.

TAB bank is a factoring company that has provided factoring for over 20 years with no personal credit requirement. TAB has a whole factoring sector dedicated to helping trucking companies. That includes from leasing or buying new equipment, to opening a new location or hiring new employees etc. Must be a US company.

Real Estate Loans

Real Estate Loans can take on different structures depending on the lender you work with and the amount of financing you need. Banks provide commercial Real Estate Loans with longer repayment terms and lower interest rates.

AMOUNT

TERMS

RATES

SPEED

Up to $5M

30+ years

5.5% to 9%

Depends on the lender

- Pros

- Financing the purchase of a building, shop, office space, or other commercial property.

- Cons

- You don’t need to acquire commercial property.

BEST Real Estate Loans LENDERS

Velocity

Best for: Real estate investors seeking leniency for approval

Velocity offers a no-doc loan. Meaning no income, asset, or tax verifications. Designed for investors seeking a simple financing solution for purchase or refinance, with the flexibility to remain in the loan for up to 30 years with no balloon payment. Also offers a product designed for investors with derogatory credit issues and high equity seeking quick and easy credit qualification. Rates range depending on credit, property type & type of transaction. A great program to expand or begin your real estate journey.

Lima One Capital

Best for: One stop shop for real estate investors

Founded for real estate investors, by real estate investors with an amazing business model. Offers a wide variety of fix and flip (FixNFlip) rehab loans, Multifamily & Rental loan options, as well as a variety of New Construction loans. Made for both beginner and experienced real estate investors. With no debt/to income underwriting, Lima will look at deal for what it is and the profit that can be made.

Amza Capital

Best for: Commercial Real Estate

Specialists for Commercial Real Estate (CRE) lending. If you are planning to purchase any kind of income-producing property such as residential rental property, retail malls, shopping centers, office buildings, complexes or hotels – AMZA Capital can help you. Also offers flixnflip and buy-to-rent programs. Crafts a lending solution around almost any combination of credit, collateral or cash flow. Amza also offers incredible non-recourse solutions, meaning that the borrower is safe against any recovery efforts, leaving only the property on the line.

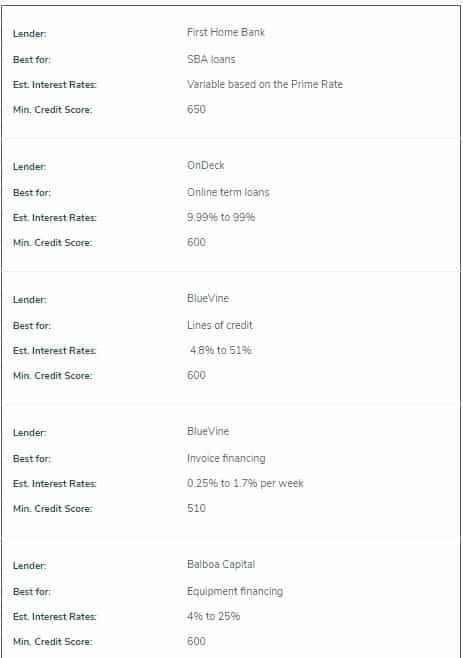

The Best Business Loans and Lenders, Summarized

| LENDER | BEST FOR | EST. INTEREST RATES | MIN. CREDIT SCORE |

|---|---|---|---|

Cadence Bank | SBA loans | Variable based on the Prime Rate | 650 |

First Home Bank | SBA loans | Variable based on the Prime Rate | 650 |

OnDeck | Online term loans | 9.99% to 99% | 600 |

BlueVine | Lines of credit | 4.8% to 51% | 600 |

BlueVine | Invoice financing | 0.25% to 1.7% per week | 510 |

Balboa Capital | Equipment financing | 4% to 25% | 600 |

The Best Business Loans and Lenders, Summarized

Learn More About Loan Types

SBA Loans

Term Loans

Business Lines of Credit

Who Is Fundera?

Getting the right business loan for you can be challenging—there are many different loan types available, and many lenders offering them. If you work directly with just one lender, how can you be sure you’re getting the best type of loan, interest rates, and terms for your unique financing needs?

That’s where a marketplace like Fundera comes in.

Fundera connects small business owners to the best loan option for them through our online marketplace of vetted business lenders. With one simple application, you can see all the products and lenders you qualify for, and start evaluating which small business loan is best for your business. Fundera features leaders in every financial category, so you can rest assured that you’re accessing the best products on the market.

Nobody Knows Small Business Loans Like Us

85,000+ small businesses helped

Over $2.5 billion in financing secured

A+ BBB Rating