BRIDGE LIKE A PRO

EVERYTHING YOU NEED TO KNOW ABOUT BRIDGE LOANS

A bridge loan is a short-term loan used to purchase or refinance a property quicakly in order to take advantage of a short-term opportunity, accommodate an urgent closing, or bridge the gap until permanent financing is available. Bridge loans close much faster than term loans or conventional loans because there’s less guidelines, therefore there is less underwriting and documentation needed.

Bridge loans are temporary loans, the typical property bridge loan has a term of 12-24 months, although many bridge lenders will grant the owner the option to extend his loan for six months to one year. This type of financing is secured by the real estate asset itself.

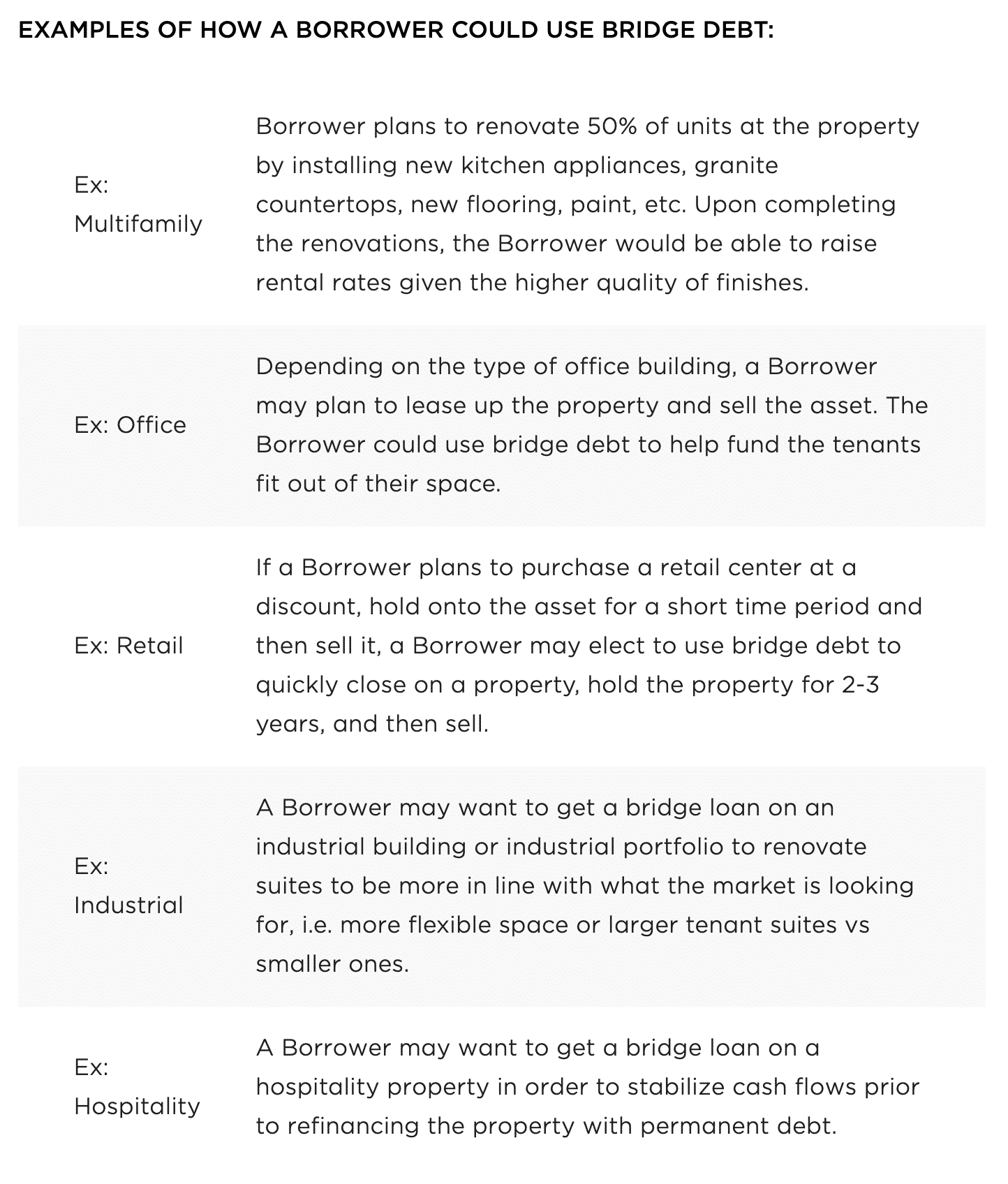

Like a typical bridge Loan, which is a short term loan, the same structure and outline can be utilized on commercial properties in a commercial bridge loan except that terms are longer here. This type of loan can also be a valuable tool for purchase or refinance of office buildings, hotels, retail property, and multifamily housing including apartment complexes.

2. Sale & Leaseback Scenarios needing a quick closing

3. Distressed Sales, IRS Liens, Bankruptcy Resolutions, Debt Consolidation

4. Partner Equity Buyouts Mortgage Acquisitions and Discounted Mortgage Buybacks

5. Rehab & Conversion opportunities which require property stabilization before permanent financing can be obtained

- Speed of closing: Bridge loans provide short term financing in just a few weeks, as opposed to home mortgages originated by a traditional lender. This speed allows investors to buy time and get the sale price or permanent long-term finance solution they ultimately want, instead of being forced to settle for a deal that doesn’t pencil out.

- Opportunities for real estate investors: Obtaining a bridge loan means a real estate investor can take advantage of opportunities they would otherwise have to pass over. For example, a borrower can use the funding to buy one property that becomes available while they are selling another, without using a contingency clause or waiting for the first property’s sale to go through.

- No Immediate Payments:Typically lasting a few months, and up to one year, bridge loans often allow a few months before the first payment is due. This provides buyers with a little bit of breathing room to get their finances in order.

- Short turnaround: Bridge loans are ideal when a borrower needs cash ASAP. The loans are well-suited to helping borrowers who might be struggling with cash flow and who need a boost to get them through until a second loan gets approved or until they make a significant sale. Since bridge loans often have a short term, lasting less than one year, investors who participate in bridge funding programs can expect to see a return on their investment sooner rather than later.

- Adapt To Market Shifts:There are some scenarios in which a buyer must purchase a new home, yet may encounter difficulty selling their original property immediately. Examples may include a work-related relocation, or an unexpected lull in the market. A bridge loan offers a solution for buyers who need to buy time to sell an existing property.

- Higher Interest Rates: A common attribute for short-term financing options, the interest rate for a bridge loan is typically two percentage points higher than an average mortgage loan. The lender may increase the rate based on the level of perceived risk.

- High Closing Costs: Lenders will often inflate the closing costs for a property financed with a bridge loan, as they will assume that the buyer presents a strong desire to purchase the property.

- Prepayment Penalties: Because bridge loans accrue interest at a higher rate, borrowers are understandably incentivized to pay off the loan as soon as possible. However, most loans have a prepayment penalty written into contract. Those who do not want to pay a penalty should plan to pay off the loan at its maturity.

- Financial Management: Managing liens on two properties and accruing bridge loan interest at once, may cause stress for those who do not have a clear financial plan.